Pension cola calculator

Every month you delay benefits increases your checks slightly until you reach. All military retirements are protected from inflation by an annual Cost of Living Adjustment COLA based on changes in the Consumer Price Index CPI as measured by the Department of Labor.

How To Calculate The Value Of A Pension For Divorce

Pensions also known as Defined Benefit plans.

. When it comes to retirement planning Americans are often way behind. Under federal law the cost-of-living adjustments to VAs compensation and pension rates are the same percentage as for Social Security benefits. Those who have worked in government jobs for over ten years may receive the MRA10 pension.

The system provides retirement disability survivor and death benefits to its members and their beneficiaries. The MSRB administers the Massachusetts State Employees Retirement System MSERS for state employees and certain other employees of public entities. The Time Value of Money formula calculates this nicely.

A pension is more valuable than you realize in a low interest rate environment. Pensions from work not covered by Social Security. Im using my trusty calculator.

If Future value 0 Payment 100 N 180 15 years 12 months per year and I 0 then Present Value 18000. The original Social Security Act was enacted in 1935 and the current version of the Act as amended encompasses several social welfare and social insurance programs. The windfall elimination provision affects how the amount of your retirement or disability benefits is calculated if you receive a pension from work where Social Security taxes were not taken out of your pay.

Periodically VA makes cost-of-living adjustments COLAs to VA compensation and pension benefits to ensure that the purchasing power of VA benefits is not eroded by inflation. The cost of living adjustment COLA is based on the Consumer Price Index and should generally fall in the 1-3 range. ASCII characters only characters found on a standard US keyboard.

In the United States Social Security is the commonly used term for the federal Old-Age Survivors and Disability Insurance OASDI program and is administered by the Social Security Administration. Page includes 2022 Cola. In fact in 2019 almost half of households headed by someone 55 or older had no retirement savings at all according to the U.

Social Security COLA For 2023. Whether you have a state federal or private retirement pension start now. Buy Car Calculator.

A modified formula is used to calculate your benefit amount resulting in a lower Social Security benefit. Plan 1 Optional COLA calculator. Pension policies can vary with different organizations.

With a pension you wont be forced to lower your safe withdrawal rate in retirement like those of use who dont have pensions. 6 to 30 characters long. It uses a financial calculator which is something that Ive never been good at.

The MSERS is a contributory defined benefit system governed by Massachusetts General Law Chapter 32. If you are part of a defined benefit pension remember that the value in these types of pensions really comes with tenure and time. COLA - weekly wage increase after the government announced budget.

The windfall elimination provision affects how the amount of your retirement or disability benefits is calculated if you receive a pension from work where Social Security taxes were not taken out of your pay. 75728963 Benefits paid to retirees and their beneficiaries over the last fiscal year. FERS Early Retirement Bumps In Pension A FERS early retirement bump will not increase your pension amount.

Build a Retirement Plan. Must contain at least 4 different symbols. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply.

Under the Final Pay High-36 and BRS retirement plans the annual COLA is equal to the percentage increase in the CPI year over year. Social Security and Supplemental Security Income SSI benefits for approximately 70 million Americans will increase 59 percent in 2022. Security and receive a pension because of that job.

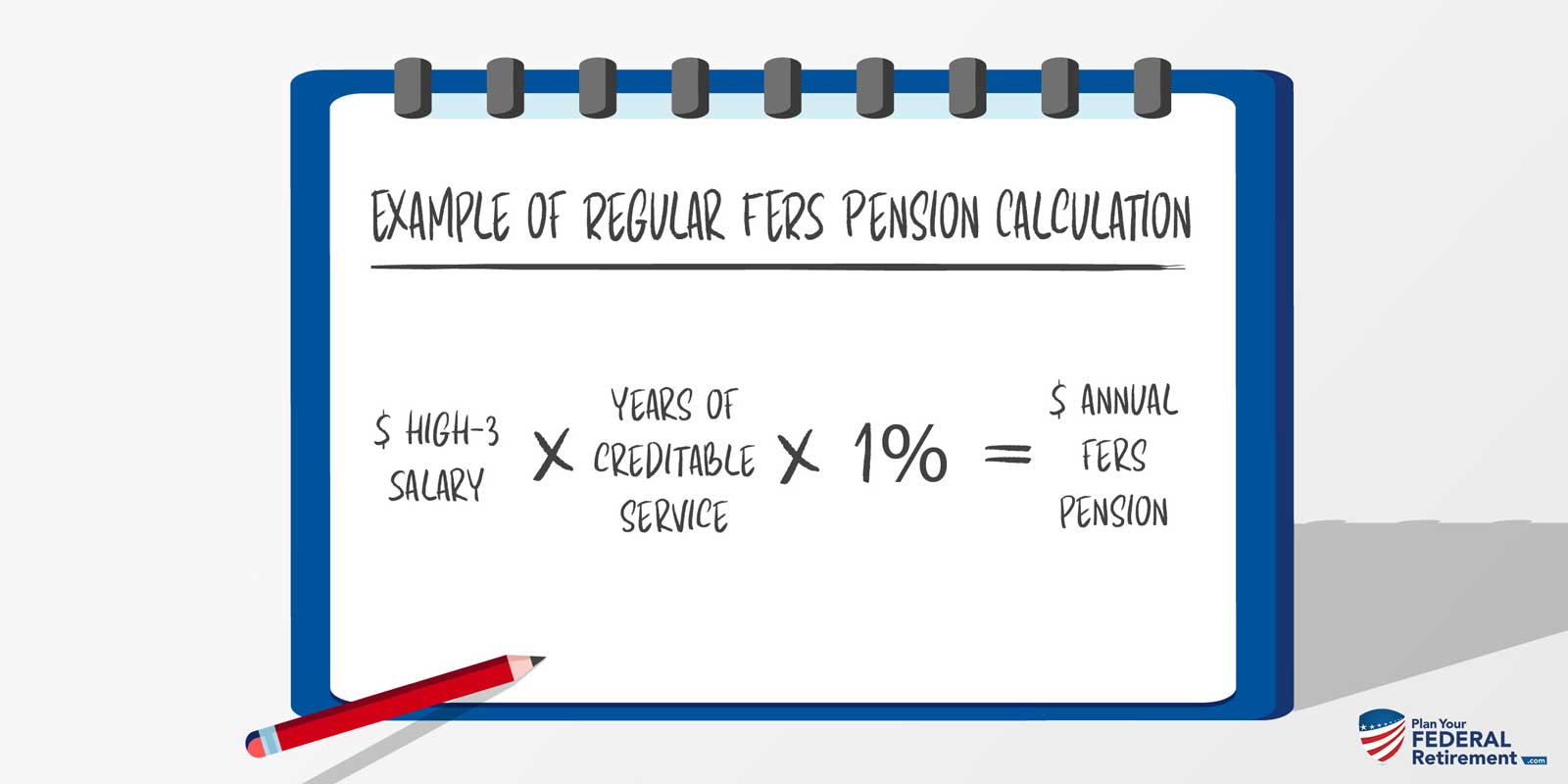

A modified formula is used to calculate your benefit amount resulting in a lower Social Security benefit. It looks like this might be worth more value when you are looking at a point somewhere in the future when you get access to the. Use this simple High 3 and FERS retirement calculator online as a guide to get started.

Cost-of-Living Adjustment COLA Information for 2022. The City of El Paso Employees Retirement Trust pays millions of dollars in pension payments to over 3500 City retirees and their beneficiaries. The federal pension calculation is complicated.

If a FERS employee retires before age 62 then the FERS annuitant is eligible to receive his or her first COLA in January of the year following the year the annuitant becomes age 62. See these tips for finding and using a retirement calculator with pension. The NewRetirement Planner allows you to specify if your pension will adjust with the Cost of Living and at what rate.

Early Retirement Bump in Pension. Because important pension-related decisions made before retirement cannot be reversed employees may need to consider them carefully. The purpose is to adjust your pension to keep up with the rising costs of housing.

Generally it is the norm to gradually increase pension payout amounts based on the COLA to keep up with inflation. Get 247 customer support help when you place a homework help service order with us. Calculating Pension Value with a Finance Calculator.

When these COLAs start depends at what age a FERS employee retires. This is because your FERS annuity will not increase if you wait until the age of 62. Any pension you receive from work not covered by Social Security could reduce the amount of your Social Security benefits in one of two.

There is an IRS withholding calculator available through your online account. This post will help you calculate the value of a pension. PERS and TRS Plan 1 members use this Excel calculator to compare your benefit with and without the optional COLA.

If you begin claiming at 62 youll get only 70 of your standard benefit if your FRA is 67 or 75 if your FRA is 66. A pension guarantees you retirement income while a 401k plan depends on your own contributions and investments. This document will help you understand how pensions based on such earnings affect Social Security benefits.

If youve got a pension count yourself as one of the lucky ones. This assumes there is a COLA in a particular year. The 59 percent cost-of-living adjustment COLA will begin with benefits payable to more than 64 million Social Security beneficiaries in January 2022.

Early Retirement The Western Conference Of Teamsters Pension Trust

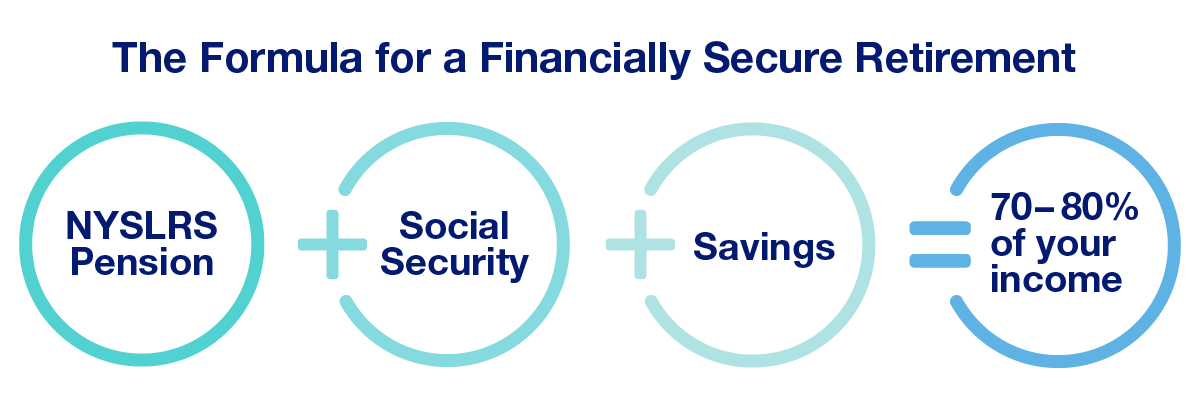

Post Retirement Income Archives New York Retirement News

Using Guard And Reserve Retirement Calculators To Estimate A Reserve Pension Retirement Calculator Retirement Guard

The Phantom Cola And Other Retirement Mysteries Federal News Network

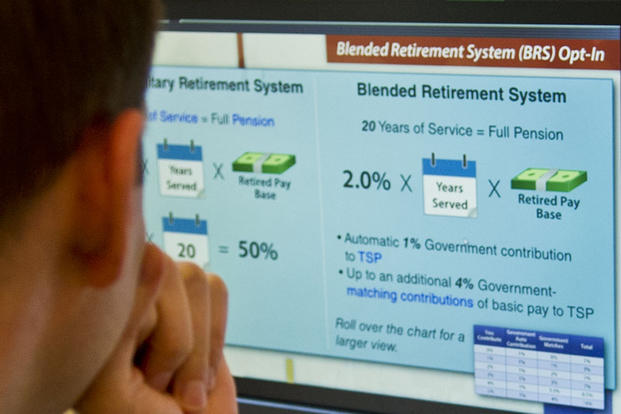

The Blended Retirement System Explained Military Com

Cost Of Living Adjustments Cola Los Angeles City Employees Retirement System

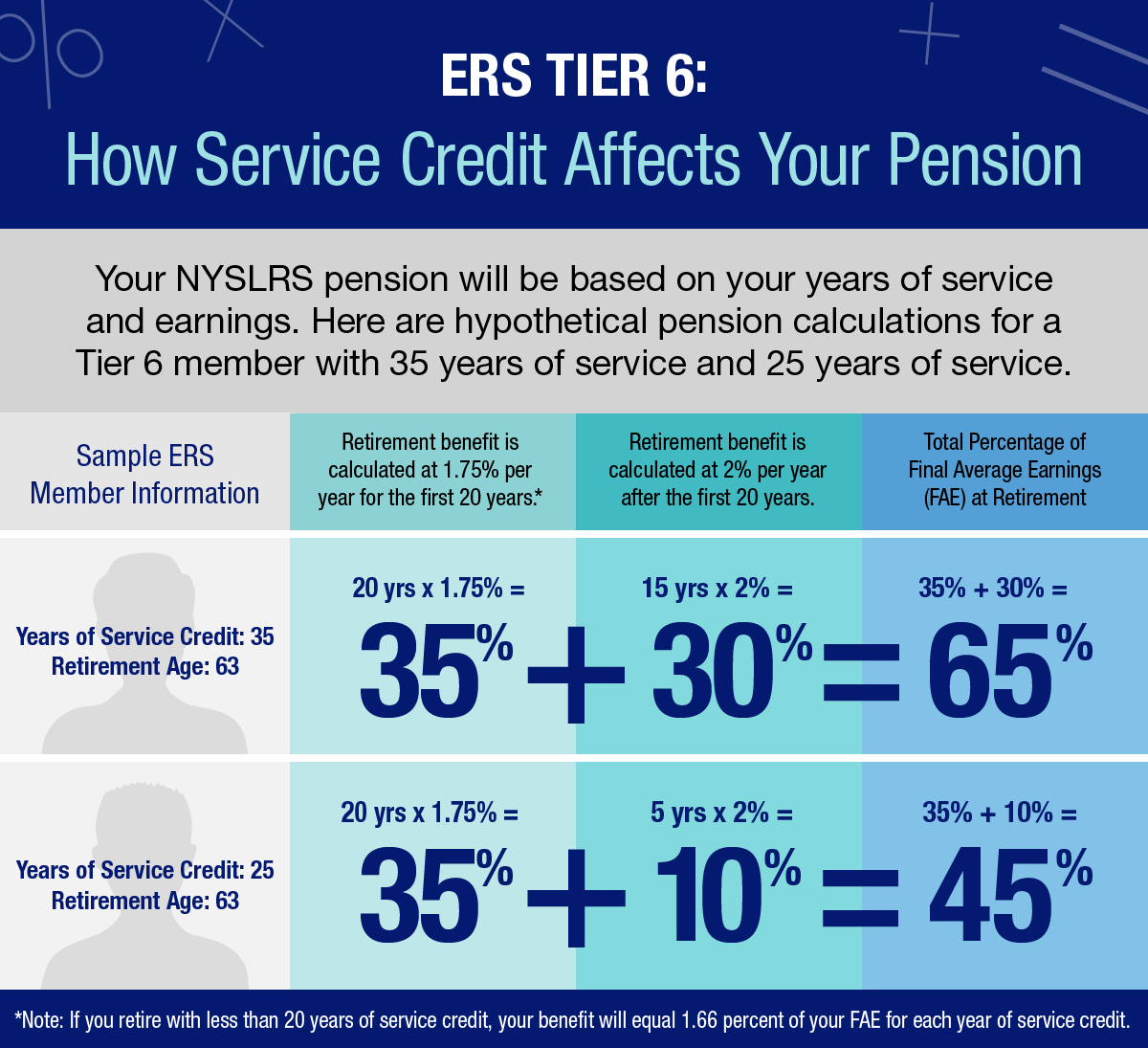

Ers Tier 6 Benefits A Closer Look New York Retirement News

/GM_Pension-2b3a5e03ee184c1a86e75a9ac4ebf2fd.png)

Projected Benefit Obligation Pbo Definition

Pension Massachusetts Laborers Benefit Funds

Service

Public Pensions In California Public Policy Institute Of California

Civil Service Retirement Pension And Social Security Benefits

Sdcers Cost Of Living Adjustment Cola For Fiscal Year 2023

Social Security Could Receive Largest Increase In 40 Years Because Of Cola In 2022 Money Skills Social Security Benefits Retirement Benefits

Post Retirement Income Archives New York Retirement News

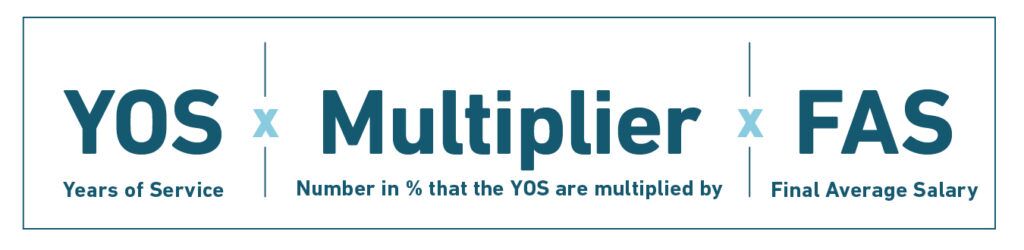

Pension Basics How Pension Benefits Are Calculated

Fers Retirement Special 10 Bonus Age 62 With 20 Years Of Service